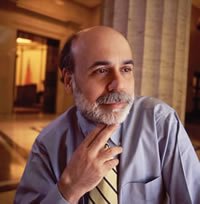

Ben Bernanke, President Bush's nominee to be chairman of the Federal Reserve, is an outspoken proponent for "inflation targeting (subscription required)." I'm no interest rate or monetary policy expert, but the basic tenants of the concept resonate with me.

Inflation targeting is essentially the concept that the Fed would publicly announce a monetary policy that targets a specific rate for inflation growth (most talked about is somewhere between 1 and 2%) or at least a range that they want it to fall in to. For the past eighteen years, under Alan Greenspan, the Fed has successfully fought inflation through the use of calculated rate increases and decreases, but has done so behind closed doors. "Fed watching," the process of guessing "what they'll do next" has become nothing less than a sport.

As mentioned in the article, the need for predictability has been known for a long time. "Economists came to realize in the 1970s that to contain inflation in the present, they needed to control the expectations of individuals and businesses about where inflation was going in the future."

The reason Inflation targeting is gaining so many proponents is that it provides much more predictability. Financial markets, while moved by hard numbers over the long term, are moved in the short-term with a heavy dose of psychology (Ben Graham's proverbial "Mr. Market"). Is it healthy for the market to change what it does in anticipation of a Fed move, and then immediately correct after new policy has been announced?

Markets crave stability. This is why in equity markets companies smooth their results by managing their earnings. Everyone knows that during the boom Cisco Systems was brining in cash hand over fist each quarter, but strangely, quarter after quarter their results would come in exactly .01 over the analyst expectations. Everyone is aware this earnings management is going on and no one cares because they know actual results are even better. It's seen as good financial management to chalk up nice predictable numbers like that.

This kind of predictability is why an inflation targeting Fed policy sits well with me. Steve Forbes has been arguing for years in his column Fact and Comment that the U.S. economy would be better served by tying monetary policy to a predictable underlying metric (in his argument, the price of Gold). While Mr. Greenspan has in many respects provided the stability the market needed by being himself, what the U.S. (and the world) needs going forward is a policy that provides the predictability and stability the market needs no matter who sits in that seat.

(Disclaimer: I've left out a discussion of the flexibility in time of crisis that the Fed would "give up" by following an inflation targeting policy. It is a valid issue/point of view. There's a good discussion of that in the article I've linked to in the WSJ at the top of this post.)

No comments:

Post a Comment